Documents Approved but Loan Still Not Released – What Happens Next

Many farmers and applicants feel happy when they receive a message that their bank loan documents have been approved. It feels like the journey is almost completed, and the machinery or funds will arrive soon. But then suddenly, nothing seems to move forward. Days turn into weeks, and sometimes even months, and the loan still does not get released.

This situation is very common in Pakistan, especially in agriculture financing programs like the CM Punjab High Tech Farm Mechanization Finance Program where thousands of farmers apply for modern machinery loans. Applicants often get confused, worried, and even frustrated because they do not know what is happening behind the scenes after document approval.

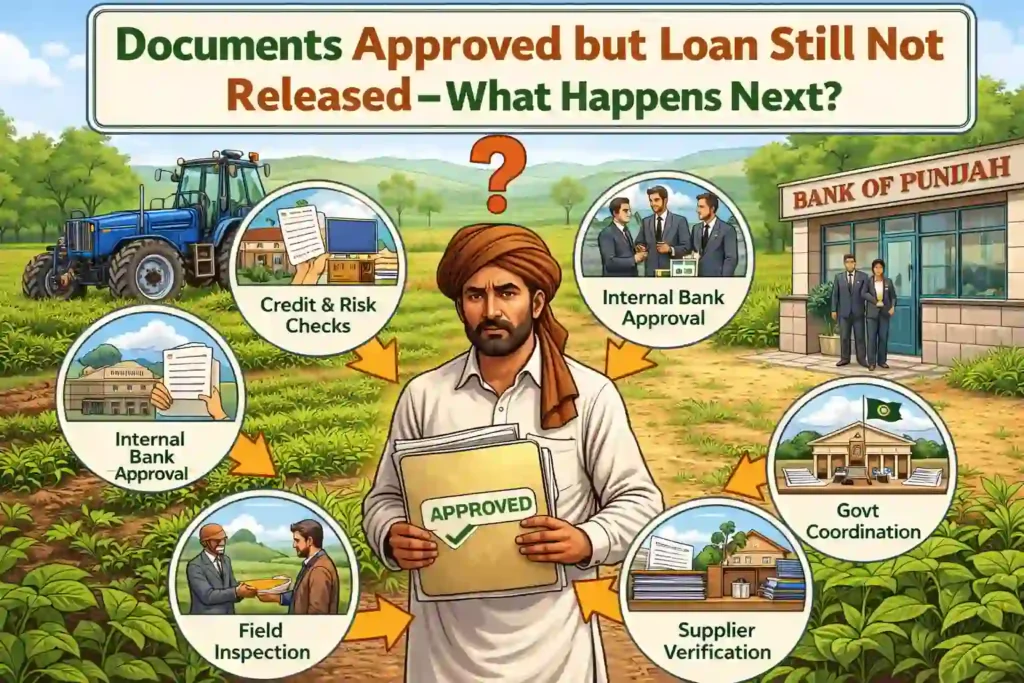

It is important to understand that document approval is not the final step, it is only one stage in a long process. After documents are approved, several internal bank procedures, government checks, financial verifications, and administrative approvals still remain. These steps are necessary because agriculture loans involve large financing amounts, government support, and strict accountability. Banks must ensure that every loan is safe, transparent, and properly justified. This protects both the bank and the applicant and ensures fairness in government programs.

Therefore, if your documents are approved but the loan is still not released, it does not automatically mean rejection or cancellation. Most of the time, it simply means the file is moving forward through different stages of verification and approval. In this detailed article, we will explain exactly what happens next, why delays occur, what stages come after document approval, and what you should do during this waiting period to avoid problems.

What Does “Documents Approved” Actually Mean?

When the bank says documents approved, it usually means:

- Your CNIC and identity verification are completed

- Your land papers or business proof have been checked

- Your basic eligibility has been confirmed

- You are fit according to the loan policy

- No major technical issue is found in your application

This is a positive milestone. It shows that your application is moving in the right direction and you are now a serious candidate for loan disbursement. However, people mistakenly think this is the final approval, but in reality, it is just the completion of pre-verification stage.

Why Is the Loan Still Not Released After Approval?

There are several reasons why banks hold loan disbursement even after approving documents. These reasons are logical and part of standard banking rules.

Final Credit Approval Stage

Once documents are approved, the bank’s credit department evaluates your file. They assess:

- Financial risk

- Repayment capacity

- Existing liabilities

- Credit behavior (if applicable)

This department decides whether the bank should actually release money or not. Sometimes, even after document approval, credit teams may require:

- Additional documents

- Clarifications

- Updated papers

This stage may take time depending on workload and internal processing.

Internal Approvals and Management Signatures

Many agriculture loans, especially high-value machinery loans, require approval from:

- Branch Manager

- Regional Head

- Credit Committee

- Head Office (in some cases)

Each level takes time because:

- Officers review documents carefully

- Files move between departments

- Approvals are recorded for transparency

- Compliance laws must be followed

This step ensures proper record keeping and security of public finance.

Coordination with Government Programs

If your loan is part of programs like the CM Punjab High Tech Farm Mechanization Finance Program, then:

- Government guidelines must be followed

- Subsidy or interest support verification is completed

- Program monitoring teams review the file

This coordination adds additional time but ensures benefits reach genuine and deserving applicants.

Machinery Supplier & Quotation Verification

For agriculture machinery loans, the bank confirms:

- The supplier is registered and legitimate

- Machinery price is correct

- Quotation is original

- Machine availability is ensured

Sometimes banks contact suppliers directly for confirmation. If suppliers delay response or documents are incomplete, loan disbursement pauses temporarily.

Physical Verification and Site Visits

In many cases, banks conduct:

- Farm visit

- Business location verification

- Machinery requirement assessment

Field visits naturally take time due to:

- Staff availability

- Distance to rural areas

- Scheduling challenges

- Weather or seasonal workload

Until inspection is completed, the loan amount may not be released.

Legal and Technical Checks

Banks sometimes conduct additional checks such as:

- Ensuring land is not disputed

- Confirming property is not already mortgaged

- Verifying signatures and legal undertakings

These steps protect you from future legal complications and ensure safe lending.

Banking System and Administrative Delays

Sometimes delay happens simply because of:

- File backlog

- System updates

- Slow processing

- Load of applications

- Bank holidays or official closures

These delays are normal and do not mean rejection.

What Should You Do During This Waiting Period?

Instead of worrying, take the following smart steps:

Stay in Contact with Your Bank Branch

Visit or call politely. Ask:

- Current status of your loan

- Which stage your application is in

- Whether any additional requirement exists

Regular follow-up shows seriousness and keeps your file active.

Keep All Your Documents Ready

Maintain copies of:

- CNIC

- Land papers

- Application forms

- Bank communication

This helps when bank requests verification again.

Cooperate Fully with Bank Staff

Provide any additional information immediately. Delays mostly occur when applicants respond late.

Avoid Panic or Negative Assumptions

Approval takes time in structured programs. Many applicants receive funds after some waiting period.

Common Reasons Why Some Loans Get Delayed Longer

Even after document approval, loans may face longer hold if:

- Land dispute exists

- Applicant has previous unpaid loan

- Bank doubts repayment capability

- Policy changes occur

- Required budget quota is full temporarily

Such cases require deeper review.

How Long Does It Normally Take After Document Approval?

Although time varies, generally:

- Simple cases: 2 to 4 weeks

- Medium cases: 1 to 2 months

- Complicated cases: longer, depending on verification issues

Patience is important.

Does Approval Guarantee Loan Release?

In most cases yes, but it is not a 100% guarantee until final sanction and disbursement. But if documents are approved, your chances are already very strong.

Frequently Asked Questions (FAQs) about Agriculture Machinery Loans:

✔️ My documents are approved. Does it mean loan is confirmed?

It means you passed a major stage. Final confirmation happens at credit approval and disbursement stage.

✔️ Why did my friend get loan earlier than me?

Processing time varies based on file complexity, bank branch speed, verification difficulty, and program category.

✔️ Can my loan still be rejected after document approval?

Yes, if serious issues are found later such as fake records, land dispute, ineligibility, or risk concerns.

✔️ What should I do if delay is too long?

Visit the branch, meet the manager, and request update in written form if necessary.

Final Words – Documents Approved but Loan Still Not Released What Happens Next

If your documents are approved but loan is still not released, do not panic. This situation is normal and part of the banking process, especially in agriculture financing programs like the CM Punjab High Tech Farm Mechanization Finance Program. Approval comes in stages, and document approval simply means your application is progressing positively. After this, internal approvals, credit review, field verification, supplier confirmation, and government coordination continue before releasing the loan.

The best approach is to stay patient, remain in touch with the bank, provide any required detail quickly, and avoid misinformation. With proper follow-up and cooperation, most genuine applicants successfully receive their loans and benefit from modern agricultural development.