Missed an Installment? Here’s What Happens in Agriculture Loans

Agriculture loans have become a major support system for farmers across Punjab and Pakistan. These loans help farmers buy tractors, harvesters, irrigation systems, seeds, fertilizers, and other essential farm inputs. Many government-backed schemes also offer easy installments and low or even zero markup, making farming more affordable and modern.

However, despite these facilities, many farmers face financial pressure due to weather conditions, crop losses, market price fluctuations, or personal emergencies. In such situations, missing an installment becomes a real concern. Farmers often worry about penalties, blacklisting, or legal action, but most of them do not fully understand what actually happens when an installment is delayed.

This article explains, in simple words, what happens if you miss an installment in an agriculture loan. It covers the real consequences, common misconceptions, how banks and government programs usually respond, and what farmers should do immediately after missing a payment.

Understanding Agriculture Loan Installments

Agriculture loans are usually given with a clear repayment schedule. Most loans are repaid in monthly, quarterly, or seasonal installments. The installment amount is decided based on loan size, repayment period, and farmer’s capacity.

Banks and government programs understand that agriculture income is not regular like a monthly salary. That is why many agriculture loans allow flexible repayment schedules linked with crop seasons. Still, timely payment is considered important to keep the loan account healthy.

Missing an installment does not mean instant punishment, but it does trigger a process that every farmer should be aware of.

What Is Considered a Missed Installment?

A missed installment means that the payment was not made by the due date mentioned in the loan agreement. Even a delay of a few days can technically count as late payment, depending on the bank’s policy.

In many agriculture loans, a short grace period is given. During this time, farmers can pay without facing serious consequences. However, if the installment remains unpaid beyond this period, it is officially marked as overdue.

Once an installment is overdue, the loan enters a sensitive phase.

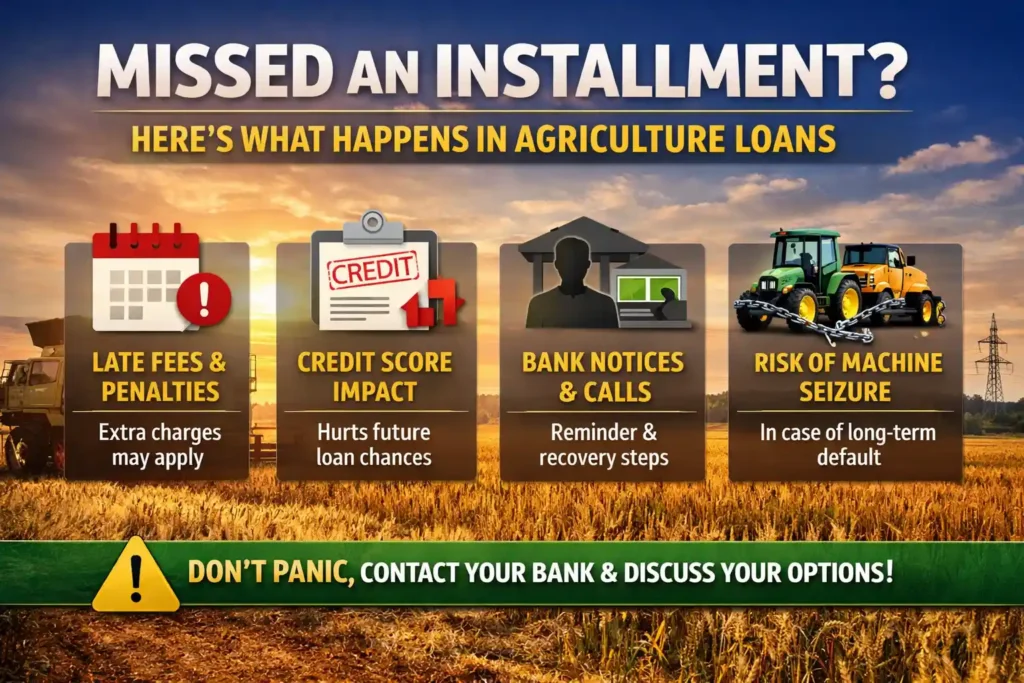

Immediate Effects of Missing an Installment

The first and most common effect is a late payment record. The bank or loan provider marks the installment as unpaid in its system. At this stage, no harsh action is taken.

Usually, the borrower receives:

- A reminder message or call

- A notification from the bank branch

- A request to visit the bank for discussion

This stage is mainly about communication, not punishment.

Late Payment Charges or Penalties

Some agriculture loans include late payment charges. These charges are usually small in the beginning but can increase if the delay continues.

For government-backed schemes, penalties are often minimal or relaxed, especially if the farmer provides a genuine reason such as crop failure, flood, or drought.

Private banks, however, may apply late fees according to the loan agreement. These charges are added to the outstanding amount and increase the total payable sum.

Impact on Credit History

One of the most serious long-term effects of missing installments is damage to credit history.

When an installment remains unpaid for a longer period, the loan account may be reported as irregular. This affects the borrower’s credit profile, which is used by banks to judge future loan applications.

A weak credit history can:

- Reduce chances of future agriculture loans

- Delay approval of new financing

- Limit loan amount eligibility

Many farmers ignore this impact, but it can affect financial opportunities for years.

When Does a Loan Become Default?

A loan is not considered default immediately after missing one installment. Default status usually applies when multiple installments are missed continuously.

The time period varies, but generally:

- One missed installment = overdue

- Two to three missed installments = serious warning

- Continuous non-payment = default

Once a loan is declared default, recovery procedures begin.

Bank’s Recovery Process Explained

Banks prefer recovery through discussion rather than force. Initially, they try to contact the borrower and understand the problem.

If no response is received, the bank may:

- Send written notices

- Call the guarantor (if any)

- Request partial payment

Only in extreme cases, after long delays, legal recovery steps are considered. These steps are rare in agriculture loans, especially government-supported ones.

Effect on Subsidy or Markup Support

Many agriculture loans come with government subsidy or markup support. Missing installments can affect these benefits.

If installments are not paid on time:

- Markup subsidy may be suspended

- Government support may stop temporarily

- Loan may convert into a normal commercial loan

This increases the financial burden on the farmer.

Can Machinery Be Taken Back?

In mechanization loans, machinery is often pledged as security. Farmers worry that missing an installment means immediate seizure of equipment.

In reality, machinery is not taken back immediately. Recovery of assets is always the last option and only used if:

- The borrower completely stops communication

- Long-term default occurs

- All recovery efforts fail

Cooperation with the bank usually prevents this situation.

What Farmers Should Do Immediately After Missing an Installment

The most important step is not to panic. Missing one installment does not end everything.

Farmers should:

- Contact the bank branch immediately

- Explain the reason honestly

- Request rescheduling or extension

- Pay partial amount if full payment is not possible

Banks are more cooperative when farmers approach them early instead of avoiding communication.

Rescheduling and Relaxation Options

In genuine cases, banks may offer:

- Installment rescheduling

- Payment extension

- Temporary relief

- Seasonal adjustment

Government agriculture loans often include built-in flexibility for unforeseen circumstances. Farmers just need to request it properly.

Common Mistakes Farmers Should Avoid

Many farmers make mistakes that worsen the situation, such as:

- Ignoring bank calls

- Assuming one missed installment has no impact

- Depending on verbal promises without written confirmation

- Taking new loans to pay old ones

Avoiding these mistakes can save farmers from serious financial stress.

How to Prevent Missing Installments in Future

Prevention is always better than cure. Farmers should:

- Plan installments according to crop cycles

- Keep emergency savings

- Track due dates carefully

- Avoid over-borrowing

Good financial planning ensures smooth repayment and long-term benefits.

Final Thoughts – Missed Installment Agriculture Loans

Missing an installment in an agriculture loan is a serious issue, but it is not the end of the road. Most banks and government programs understand the realities of farming and offer solutions if farmers communicate honestly and timely.

The real problem starts when installments are ignored continuously. Awareness, communication, and early action can protect farmers from penalties, default status, and long-term financial damage.

Agriculture loans are meant to support farmers, not punish them. Responsible borrowing and smart repayment ensure that these facilities remain available for everyone in the future.